Getting approved for the DTC is a daunting task but many individuals can and are successful in completing it on their own. Even though it’s our job to file your disability application for you—that’s how we make our money!— we encourage individuals to file independently for the Disability Tax Credit in order to save on our professional fee.

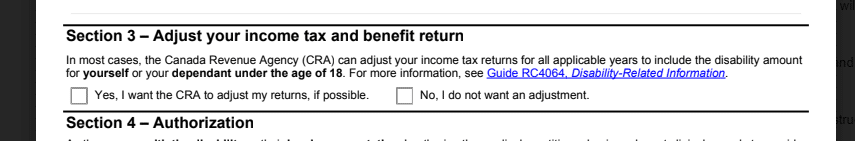

But there are some drawbacks. You may not be aware of the many benefits waiting for you, whether Federal or Provincial, and you may miss some of the necessary paperwork. You come across this section on the form and innocently check the box: “Yes, I want the CRA to adjust my returns, if possible.”

Seems simple enough, right? In reality, requesting an adjustment can really mess things up!

- The CRA will go ahead and reassess all tax years involved. What if there were other issues on your taxes? Not a great idea to have the tax guys open an old file…

- Not all benefits are automatically adjusted by ticking off that box. You would still need to send in a proper tax adjustment request to ensure that all benefits are received.

In our experience, you might be better off checking off “No, I do not want an adjustment,” and doing your accounting work the old-fashioned way with a proper request that won’t trigger a full reassessment.

So, go ahead. We encourage you to try to file yourself. However, if you are concerned, you can ask the professionals at DFAC, where our accounting experts can review your file to make sure you are receiving every possible benefit. Let us take care of the paperwork, instead of the CRA. If we can’t help you earn more benefits, you owe us nothing. Challenge us! We are ready to help you today.